Transforming Retail GCCs With Talent & Tech Advantage

Published on

Harnessing advanced technological capabilities, strategic decision-making, and a pool of exceptionally skilled professionals, Global Capability Centers (GCCs) in India are playing a pivotal role in shaping and powering retail giants across the globe.

Over the past decade, we have seen GCCs progressively ascend the value-creation hierarchy within the Retail/CPG landscape, assuming crucial roles where they actively contribute to technological advancements, innovation, and decision-making processes.

A staggering 30% of global Retail/CPG giants have chosen India as the base for their GCC

This surge, fueled by success stories like Walmart, Target, FedEx, IKEA, Pepsico and 3M shows no signs of abating, with 25 new centers anticipated within the next three years.

Factors That Make India the No.1 GCC Destination

- Access to talent: Over 60,000 highly skilled professionals drive innovation and digital transformation for their global headquarters within these GCCs. Access to skilled talent across a wide range of tech as well as non-tech skills is one of the biggest magnets pulling retail giants to India.

- Robust digital infrastructure: India’s high-speed internet, vast data centers, and tech-savvy workforce create a seamless digital playground for GCCs, enabling instant global collaboration and rapid innovation. This robust infrastructure slashes operational costs, fuels faster turnaround times, and empowers GCCs to deliver cutting-edge solutions for their global headquarters.

This synergy of skilled professionals, superlative infrastructure, and a proactive approach to value creation positions India as an undeniable magnet for global industry leaders seeking a competitive edge in the retail landscape.

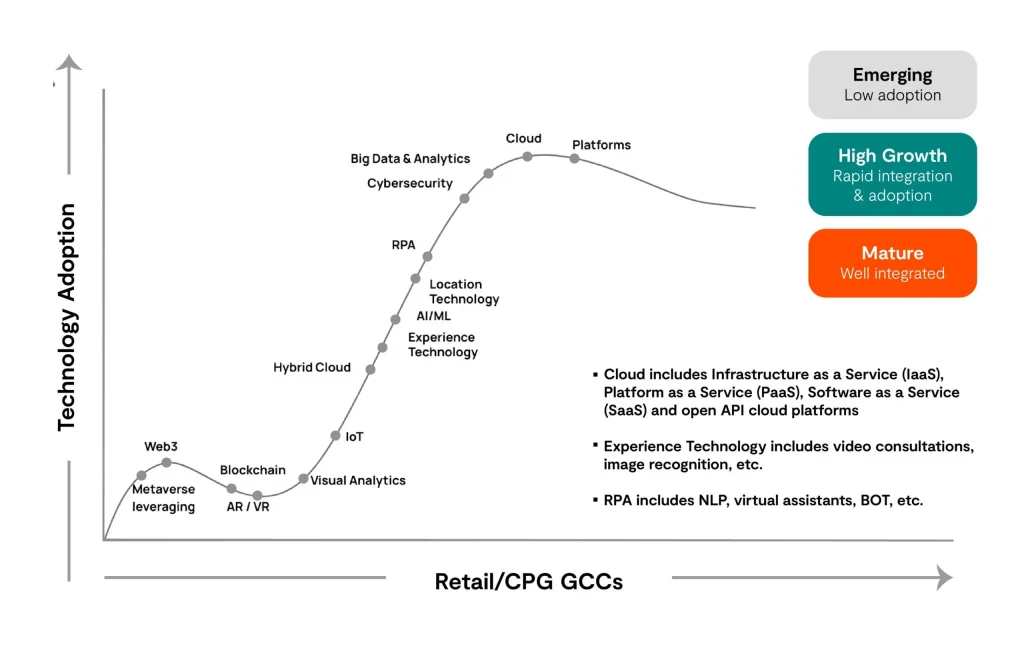

Empowering Headquarters: GCCs Spearhead Innovation Through Rapid Tech Adoption

Platform Powerhouse

Retail/CPG GCCs are building digital platforms that connect consumers with entire business ecosystems, driving a shift towards platform-based growth models for their HQs.

Location Intelligence

With advanced Location Intelligence capabilities, these hubs are researching new store locations, optimizing existing ones, and streamlining operations.

From AR/VR to Web3

Augmented reality and virtual reality have found increasing applications in retail through GCCs in the past five years, while blockchain technology is being harnessed for fraud detection and even exploring Web3 and Metaverse integrations.

These GCCs are not just cost centers; they’re innovation engines propelling their HQs into the next era of retail.

Target: Powering a Robust eCommerce Platform

With over 2000 retail stores across the US, Target wanted to build a robust eCommerce platform. In 2005, Target partnered with ANSR to set up their GCC in India.

Today, Target in India is enabling a diverse range of functions by leveraging AI, ML, engineering, data science and Gen AI. The team is building unique functionalities like a Guest Order Management system, Enterprise Checkout system, 2-day delivery and 3D Shoppable rooms on target.com.

Ready to kickstart your digital transformation?

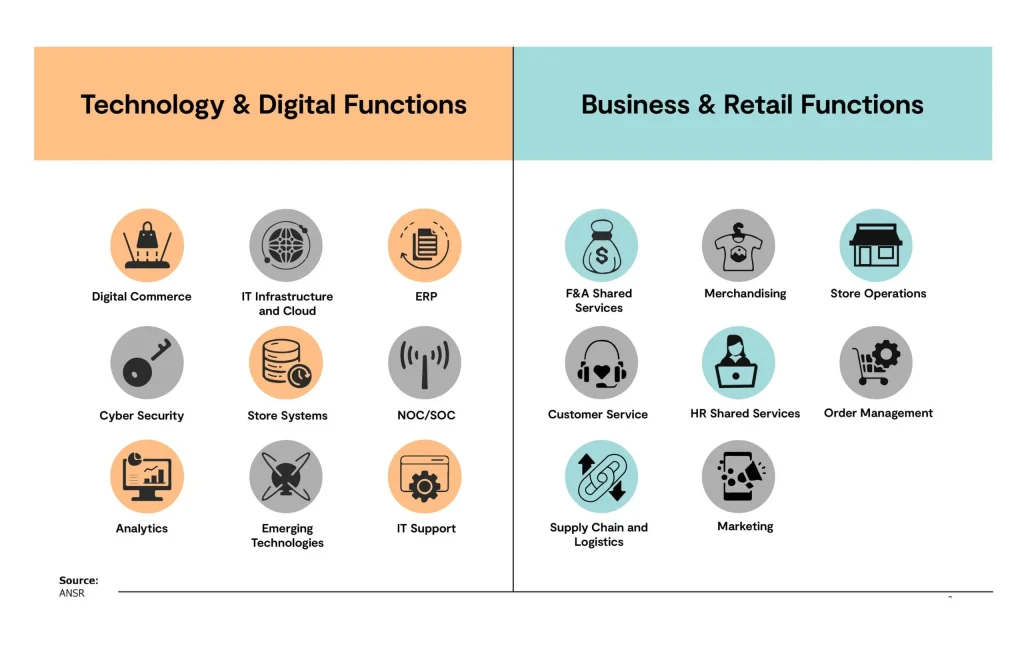

Retail GCCs Support Strategic Technology & Business Functions

GCCs have transformed into hubs of innovation, driving a diverse array of technological, digital, business, and retail operations for Fortune 500 enterprises worldwide.

These centers play a pivotal role in facilitating companies to expand and modernize their eCommerce capabilities, harness the power of data analytics through robust IT and cloud infrastructure, and implement top-tier cybersecurity measures and streamlined single-point store systems. Moreover, GCCs also provide a strategic edge through access to an ecosystem of partners and service providers, facilitating seamless integration across all aspects of business and retail functions. This includes customer service, supply chain logistics, merchandising, marketing, and even store operations.

Representation of Tech Talent Across Retail GCC Sub-domains

A closer look at the data reveals the distribution of India’s tech talent across various GCCs catering to various sub-verticals of the retail industry based on their tech skills.

- Within Stores and Supermarkets, Indian talent makes up 80% IT infrastructure & cloud , as well as analytics, followed by digital commerce (70%), cybersecurity (50%), and emerging technologies (30%).

- In Specialty Fashion Retailing, Indian GCC talent makes up 80% of IT infrastructure and cloud roles, followed by digital commerce (75%), analytics (70%), and cybersecurity (35%)

- Within the Food & Beverages industry, 85% of IT infrastructure & cloud roles, 75% of analytics roles, 70% of digital commerce roles, and 30% of cybersecurity roles are filled by tech talent from Indian GCCs.

- Within the Manufacturing sector, there is an 85% penetration within the IT infrastructure & cloud roles, 80% in analytics, 45% in digital commerce, and 40% in emerging tech roles.

- The Automotive Parts sector sees 90% penetration within the IT infrastructure and cloud roles, 80% in digital commerce and analytics and 50% in cybersecurity.

- Within the Food Service sub-vertical too, maximum penetration of tech talent is seen within the IT infrastructure & cloud roles at 90%, followed by 75% in digital commerce, 70% in analytics, and 20% in cybersecurity.

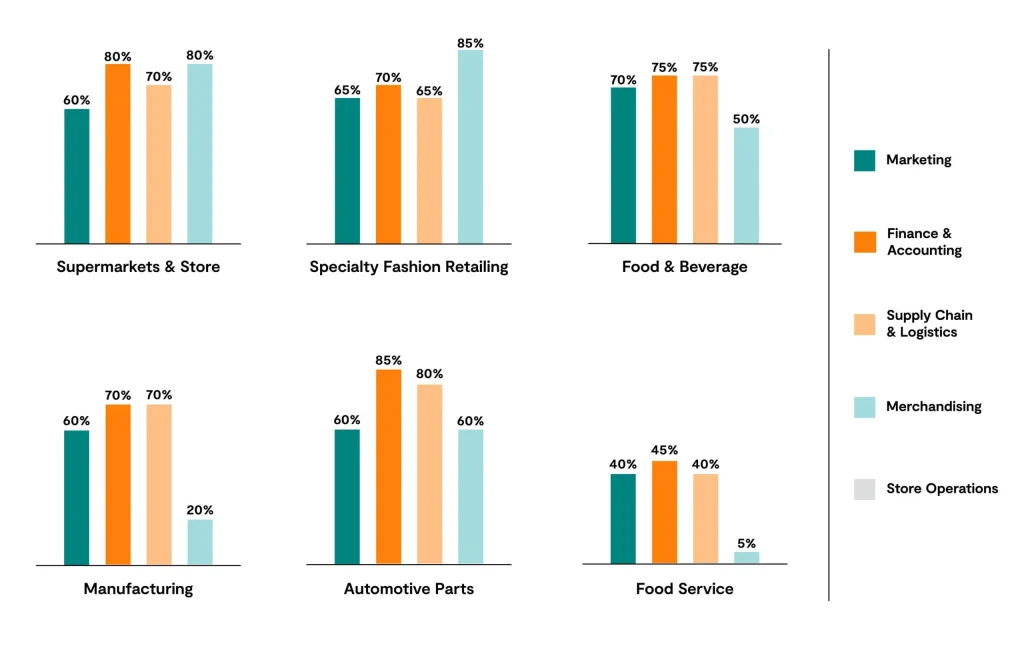

Representation of Core Business and Corporate Talent Across Retail GCC Sub-domains

Here’s what the skill distribution looks like for core business and corporate roles within the same industry sub-verticals

- Stores and Supermarkets companies see an 80% penetration for talent working in merchandising, as well as for finance and accounting, followed by supply chain and logistics (70%) and marketing (60%)

- In Specialty Fashion Retailing, maximum penetration is seen in merchandising roles at 85%, followed by finance and accounting at 70%, and marketing and supply chain logistics, both at 65%.

- Within the Food and Beverages sub-vertical, finance, accounting, and supply chain logistics see maximum penetration at 75% each, followed by roles within marketing (70%) and merchandising (50%).

- Within the Manufacturing sub-vertical, there is a 70% penetration within finance & accounting roles and supply chain logistics roles, followed by marketing at 60% and merchandising at 20%.

- The Automotive Parts sector sees maximum penetration within finance and accounting roles with 85%, followed by supply chain logistics (80%) marketing (60%) and merchandising (60%).

- Enterprises in the Food Service sub-vertical see maximum GCC talent in finance & accounting (45%), followed by marketing (40%), supply chain logistics (40%) and merchandising (5%).

Ready to build your own team?

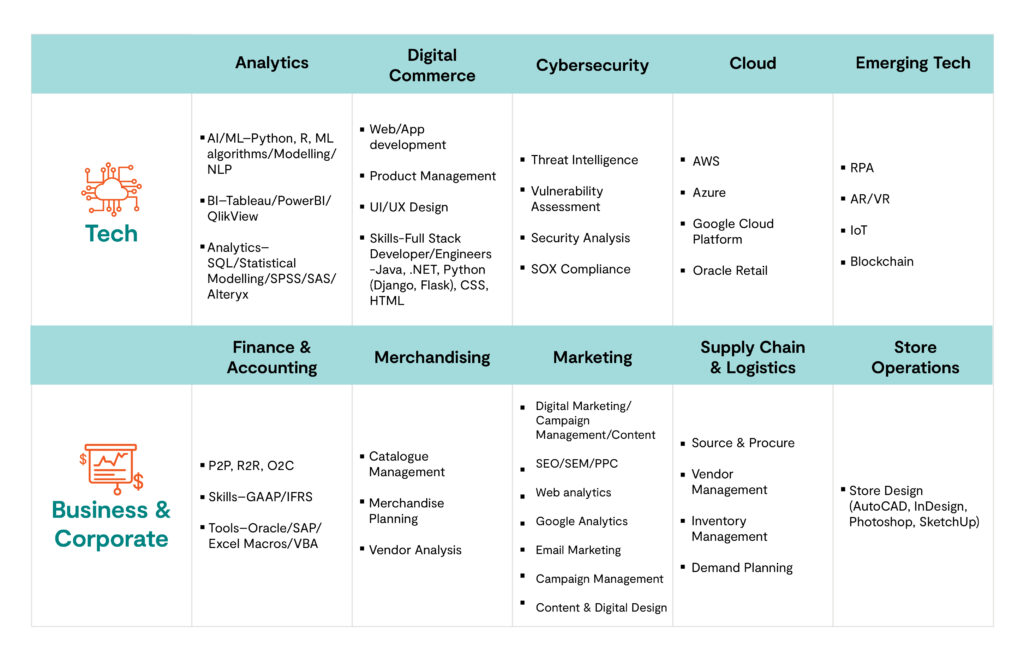

Skillset: Future-Proofing Your Retail Workforce

The talent driving this retail GCC revolution needs a unique blend of expertise. They need to understand the nuances of the retail industry while being masters of cutting-edge technologies. But what are the specific skills that make a candidate stand out in this competitive landscape?

The changing landscape of skill requirements spanning both technical and non-technical domains, clearly indicates how GCCs have evolved from support and IT centers to centers of innovation, enablement, and decision-making.

Some of the most in-demand tech skills revolve around emerging technologies (RPA, AR/VR, IoT), cybersecurity, eCommerce, analytics, and IT infrastructure and cloud. For business and core retail, the list includes merchandising, marketing, finance & accounting, and supply chain and logistics.

The verdict is clear – GCCs are powering core retail functionalities through technology, talent, and infrastructure.

Falabella: 360-Degree Digitization

Chilean apparel giant, Falabella wanted to upgrade and redesign 25 different websites along with transitioning 100% to a cloud based platform. Not only did Falabella India fulfill this goal, they also built a cloud-native, multi-tenant digital commerce platform that connects the entire Falabella ecosystem.

As a result, Falabella experienced a 114% YoY growth and 20% increase in product recommendation revenue - all thanks to the digital overhaul of its eCommerce platform, powered entirely by its India-based GCC.

Key Skills Getting Hired: The Retail/CPG Talent Hunt

Diving a little deeper, here’s a quick snapshot of the specific tech, business, and corporate skill sets and combinations that will be most in demand in 2024.

With analytics and eCommerce being the leading consumers of technical talent, AI/ML, web and application development, and UI/UX design will continue to be widely sought after. The increasing investment in cybersecurity and applications of emerging technologies will culminate in demand for threat and vulnerability assessment, SOX compliance, and tech skills like RPA, AR/VR, IoT, and Blockchain.

For the business and corporate talent pool, a fair share of the hiring focus will continue to remain on finance & accounting skills (P2P, R2R, GAAP & tools), digital marketing (SEO, Google Analytics, content and digital design), and various merchandising skills. Skills required for supply chain & logistics like sourcing and procurement, vendor & inventory management, and demand planning will see an increased demand along with an increased demand for professionals adept at store design.

India-based GCCs are Redefining Retail Success

It is 2024 and India stands at the forefront of the retail/CPG GCC revolution, propelled by a robust talent pool, a technology-centric environment, and a strategic emphasis on innovation. India’s thriving ecosystem demands a nuanced understanding of the evolving retail landscape, including the integration of advanced technologies, the optimization of data analytics, and the cultivation of an agile mindset.

From building eCommerce capabilities and leveraging cutting-edge data analytics, to streamlining operations- from supply chain to store shelves – India’s GCCs are propelling the success of their parent companies.