India’s GCCs: The Rising Force in Global Finance

Published on

India’s Banking, Financial Services and Insurance (BFSI) Landscape in a Glimpse

25%

1 in every 3

185+

Bengaluru

India is Home to 90+ Global BFSI Companies

India has evolved into an epicenter of innovation and transformation, where the world’s financial giants converge to shape the future of their industries on a global scale.

These companies have established upwards of 185 Centers of Excellence with the objective of:

- Scaling their digital and analytical capabilities

- Streamlining and optimizing their operations, and

- Diversifying and exploring new industries and markets.

AT ANSR, We’ve Helped Some of the Biggest Global BFSI Companies Set up Their GCCs

Ready to kickstart your digital transformation?

India-based GCCs are Evolving into Second HQs

- Driving niche and high-value tech functions: BFSI GCCs play a pivotal role in the digital transformation of their parent enterprises by enabling access to the holy trinity of technology – exceptional tech talent, a robust digital infrastructure, and a thriving startup ecosystem. Adopting agile development methodologies and responding swiftly to changing market dynamics, GCCs enable headquarters to rapidly develop and deploy niche tech functions and gain a competitive edge.

- Developing innovative and advanced tech competencies: Acting as the hotbeds for corporate innovation and application of disruptive technologies, GCCs are ideal for the ideation, development, and testing of proof of concepts and prototypes within a controlled environment. From Gen AI and machine learning to blockchain, RPA, and open banking technologies – GCCs are enabling their headquarters to leverage advanced tech competencies for fraud detection, risk analysis, digital payments, and countless other applications.

- Fortifying cybersecurity: With the increasing frequency and sophistication of cyber threats, cybersecurity technologies are essential for safeguarding sensitive financial data and infrastructure. BFSI GCCs are strengthening the organization’s cybersecurity capabilities by leveraging technologies like AI/ML, automation for threat detection, incident response, and security analytics. Additionally, these GCCs are also collaborating closely with the global teams to align security strategies, share threat intelligence, and ensure a uniform approach to cybersecurity across the organization.

- Actively taking ownership of key business functions: BFSI GCCs play an instrumental role in key organizational functions like risk advisory and management, comprehensive capital analysis and review, risk data aggregation and reporting, and ensuring regulatory compliance. Consequently, enterprises make better investment decisions, ensure sustainable financing, optimize capital allocation, and adhere to regulatory compliance.

Success Story: Visa’s India GCC Fuels 4.3 Billion Cards Worldwide

Visa Inc., a global payments technology company present in 200+ countries and having issued 4.3 billion cards, wanted to establish a Technology Center of Excellence (TCoE) in Bengaluru, India to accelerate the development and launch of next-generation payment products and platforms. In the absence of any on-ground recruitment infrastructure, it struggled with elongated hiring timelines and massive candidate drop-off.

Leveraging our network of 1.5 million tech professionals across 200+ platforms, we cultivated a talent pool curated to Visa’s hiring needs, increasing the initial screening success rate. By optimizing the assessment and interview process, we effectively reduced the turnaround time.

Starting operations in 2015, the TCoE could scale up to 1000+ FTEs in less than two years. Today, the center plays a strategic role in enabling Visa’s global operations, from the upgradation of existing features to building new products, effectively powering payments globally.

Facing a similar challenge?

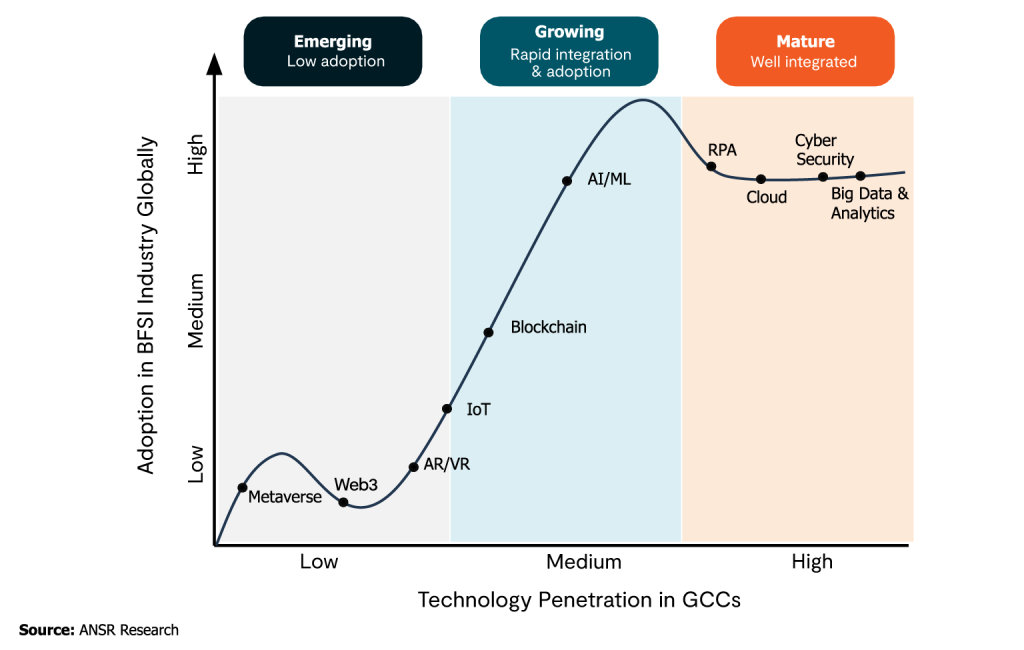

Spearheading Tech Adoption for the Headquarters

- Enterprises are actively choosing India-based GCCs for centering their cybersecurity departments due to the abundance of cybersecurity experts, security analysts, ethical hackers, and a supportive business environment. BFSI GCCs enable global banking giants to strengthen their cyber defenses, mitigate security risks, and safeguard their digital assets effectively in an increasingly interconnected and threat-prone landscape.

- The utilization of Robotic Process Automation (RPA) has witnessed a significant rise within the BFSI sector, particularly in automating the various stages of the customer onboarding process – data collection, validation, and Know Your Customer (KYC) checks, etc.

- Big data & Analytics is another area where India-based GCCs are enabling massive tech adoption for their enterprises. Companies are actively leveraging data & predictive analytics to extract valuable insights from financial transactions and customer interactions and use these insights to improve decision-making, develop targeted marketing strategies, and mitigate risks.

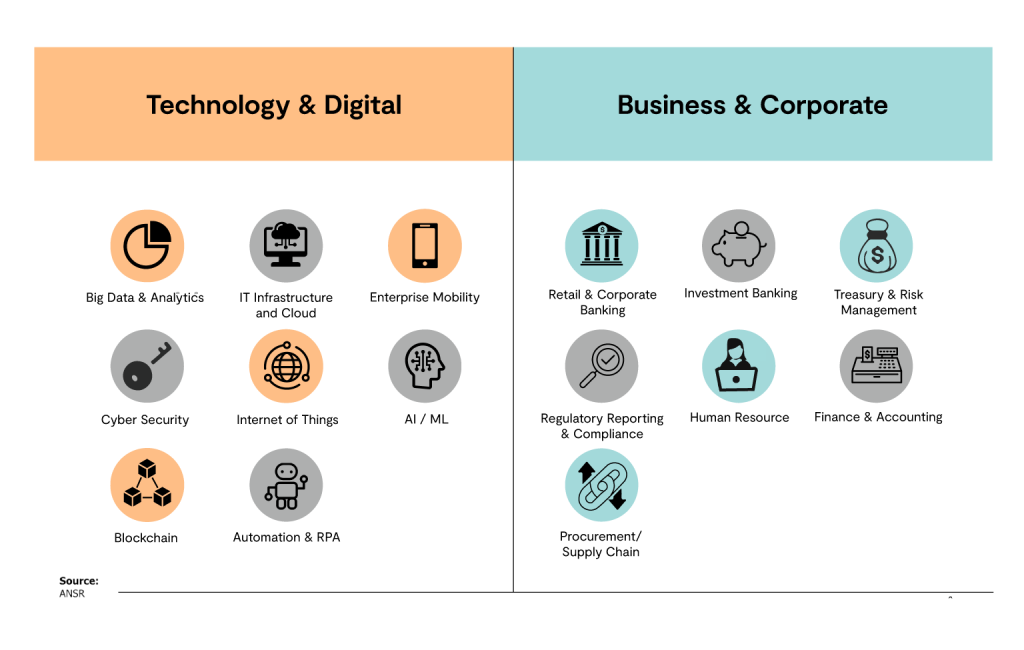

India CoEs are Driving Strategic Technology & Business Functions

The fact that some of the biggest Fortune 500 companies in the BFSI sector including Visa, American Express, Swiss Re, and First Citizen Bank are setting up over their GCCs in India is testimony to India’s sheer technological and talent prowess. These centers are driving a diverse array of technological, digital, business, and retail operations for their enterprises, helping them achieve operational excellence, drive digital transformation, and stay ahead in today’s competitive landscape.

Take the first step towards digital transformation.

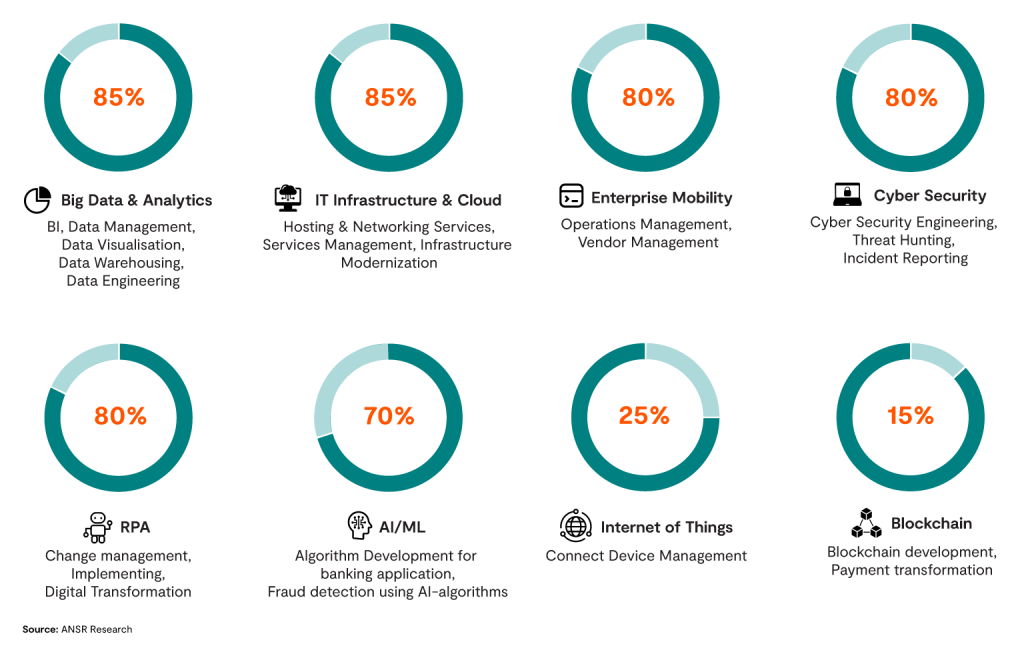

Popular Technology and Digital Capabilities Within BFSI GCCs

We’ve established that the abundance of exceptionally skilled technical talent is one of the strongest magnets attracting global BFSI enterprises. Here’s a closer look at the most in-demand technical skills within this space.

- Professionals within Big Data & Analytics as well as IT Infrastructure and Cloud domains are highly coveted, with the demand within these 2 skills at 85%.

- This is closely followed by roles in Enterprise Mobility, Cybersecurity and RPA, all three having a penetration percentage of 80%.

- Roles within the AI/ML space (algorithm development, fraud detection) see a 70% representation, followed by Internet of Things (25%) and Blockchain 15%.

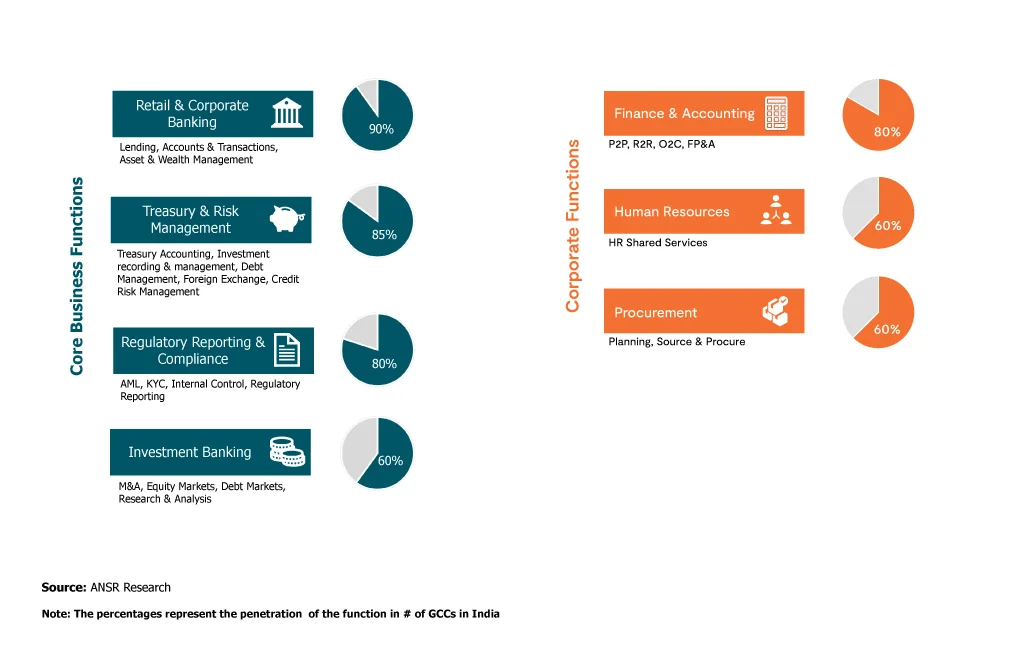

Representation of core business and corporate functions within BFSI GCCs

Here’s what the skill distribution looks like for core business and corporate roles within BFSI GCCs.

- Roles within Retail & Corporate Banking (Lending, Accounts & Transactions, Asset & Wealth Management) see maximum talent at 90%.

- This is closely followed by roles within Treasury & Risk Management (Treasury Accounting, Investment recording & management, Debt Management, etc.) at a penetration of 85%.

- GCC talent finds as much as 80% representation within Regulatory Reporting & Compliance roles (KYC, Internal control) as well as within Finance & Accounting roles.

- Finally, roles within Investment Banking (M&A, Equity Markets, Debt Markets), Human Resources (HR, Shared Services), and Procurement (Planning, Sourcing) all see a 60% penetration within this vertical.

BFSI GCC Talent Landscape: India’s Secret to Being the Top GCC Destination

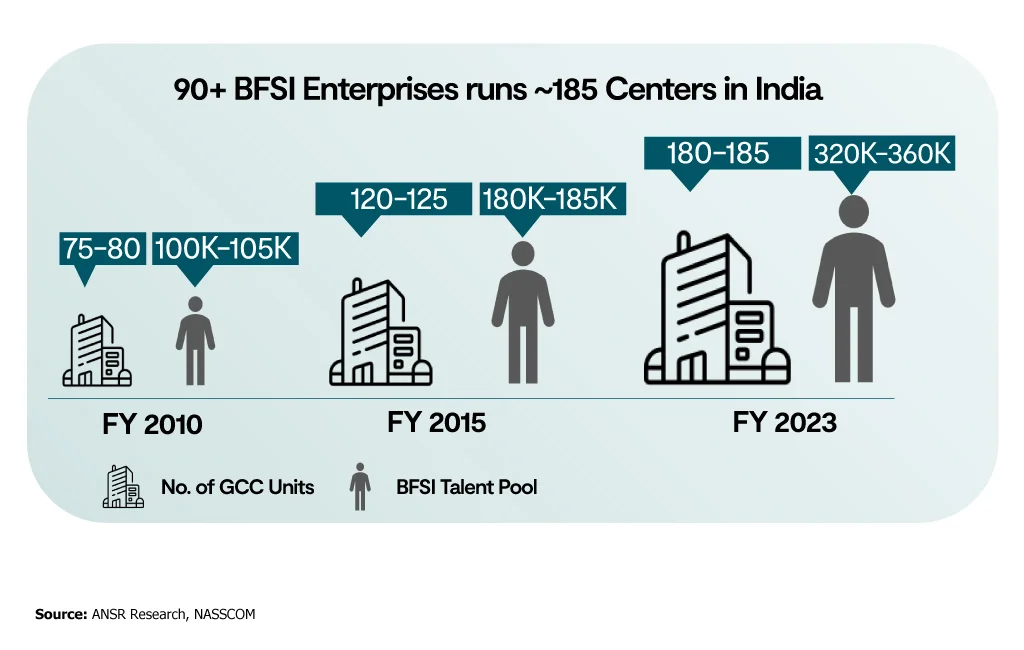

The BFSI sector has been one of the most avid consumers of India’s technical and nontechnical talent, reflecting a massive surge in talent acquisition. The talent pool has grown from 100,000 professionals in 2010, to 185,000 professionals in 2015, and a massive 360,000 professionals in 2023. The number of BFSI GCC units also mirrors this growth, increasing from 80 in 2010 to 185 in 2023.

But what’s powering this movement?

- Talent Advantage: The abundance of highly skilled, scalable, and fluent English-speaking talent pool in India provides an unparalleled competitive advantage for elevating technology, operations, and domain-specific teams to new heights of scalability and efficiency.

- Tech-powered Innovation: Moving beyond traditional back office and support functions, India-based GCCs are developing new product offerings, digital platforms, and niche technical competencies, directly driving enterprise growth at a global level. Not just restricted to AI/ML and Data Analytics, these GCCs are enabling their headquarters in the process of ideation, testing, and implementation of solutions that deploy emerging technologies like the Internet of Things, Blockchain, RPA, and many more.

- Diverse Functionalities: In addition to providing unparalleled tech competencies, India’s BFSI GCCs are also serving as specialized Centers of Excellence (CoEs) for core business and corporate functions like Risk Management, Regulatory Compliance, Capital Analysis and Review, and Risk Data Aggregation.

India’s BFSI GCCs are Driving Global Growth

Positioned as a hub of innovation and growth, India is drawing in the world’s financial powerhouses to influence the trajectory of their industries worldwide.

From fortifying cybersecurity and risk management to building and scaling platforms that power the entire digital payments ecosystem – Centers of Excellence based in India are enabling Fortune 500 banking and finance companies to stay ahead in an extremely competitive business landscape.